Mumbai, April 5 (UNI) Keeping a close watch on inflation, the Reserve Bank of India on Friday kept the key policy rate (repo) unchanged at 6.5 per cent resulting in no change in the EMIs of housing, car or other business loans. This is the seventh time in a row that the central bank has maintained a status quo.

Repo rate refers to the interest rate at which the RBI lends to commercial banks. Any cut or rise in the repo rate would have led to change in the EMIs accordingly.

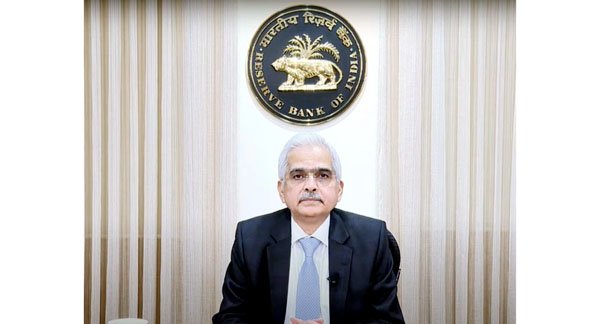

Announcing the decision of Monetary Policy Committee (MPC) RBI Governor Shaktakanta Das said even as the inflation has eased to 5.1 per cent during January and February 2024 from 5.7 per cent in December 2023, RBI remains focussed on inflation and ensure its “descent” to the target of 4.0 per cent.

Equating inflation with Elephant, Das said “Elephant moves at a slow pace. The last mile of inflation is sticky.”

He acknowledged that inflation has come down “but the task is not yet over”. As the uncertainties in food prices continue to pose challenges, the MPC remains vigilant to the upside risks to inflation that might derail the path of disinflation.

The MPC met on 3rd, 4th and 5th April, 2024. After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the MPC decided by a majority of 5 to 1 to keep the policy repo rate unchanged at 6.50 per cent.

Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent, RBI Governor said.

On the economic growth, the Governor said considering various factors both in the domestic and global markets, the Indian economy is projected to grow at 7 per cent during the current financial year.