New Delhi, Oct 6 (UNI) The Supreme Court today issued notice to the Central government on a writ petition challenging the constitutional validity of the Securities Transaction Tax (STT), which is levied on the buying and selling of stocks and other securities on Indian stock exchanges under the Finance Act, 2004.

A Bench comprising Justice J.B. Pardiwala and Justice K.V. Viswanathan issued the notice, returnable in four weeks.

“The principal argument canvassed before us is that the Securities Transaction Tax is the only tax levied in the country on the mere act of carrying out a profession and is sought to be levied irrespective of whether a profit is derived or not.

This, according to the petitioner, renders the levy almost punitive or deterrent in nature.

Otherwise, all other taxes in India are levied on profits at the year-end, but the STT is imposed even if the stock market trader operates at a loss.

Issue notice, returnable in four weeks,” the Court recorded.

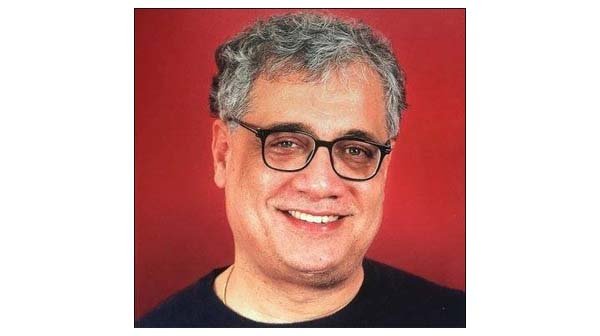

The writ petition, filed by stock market trader Aseem Juneja, seeks a declaration that STT is unconstitutional as it violates Articles 14, 19(1)(g), and 21 of the Constitution.

In the alternative, Juneja has sought a direction to allow adjustment of STT paid during a financial year against short-term or long-term capital gains tax liability, similar to how Tax Deducted at Source (TDS) is adjusted for salaried individuals.

The petitioner has argued that STT amounts to double taxation, since traders pay capital gains tax on profits while also being charged STT on every transaction.

He pointed out that while short-term or long-term capital gains taxes are levied on profits, STT currently 0.1 percent on both buy and sell sides for delivery trades, is imposed regardless of whether profit or loss is made.

Juneja further contended that STT is unique because it applies even when a trader incurs losses, making it punitive in nature.

“STT is applicable to the rupee value of shares bought or sold, not on actual profits. There is no other tax in India where a professional is taxed despite making a loss. Such a levy on transactions rather than profits is arbitrary and violates Articles 14, 21, and 19(1)(g),” the plea states.

Drawing an analogy, the petitioner compared STT to taxing a doctor on every consultation fee received even if the practice ultimately incurs a loss.

The petition notes that while STT was introduced in 2004 to curb tax evasion and function like TDS, it lacks any mechanism for adjustment or refund against final tax liability, effectively forcing traders to pay both STT and capital gains tax.

The plea also highlights that major global financial markets such as the United States, Germany, Singapore, and Japan do not impose such a tax.

The petitioner has urged the Supreme Court to either strike down the STT as unconstitutional or direct that it be adjusted against capital gains tax liability.